Where to Get Reseller Permit and Sales Tax Number in Reno Nevada

- Home

- Estate Tax Id Number Application

Estate Tax Id Number Application

Tax Number Id

Related Search

Apply for an Estate Tax ID (EIN) Number

top www.irs-taxid-numbers.com

Yes, Estates are required to obtain a Tax ID: The decedent and their estate are separate taxable entities. Before filing Form 1041, you will need to obtain a tax ID number for the estate. An estate's tax ID number is called an "employer identification number," or EIN, and comes in the format 12-345678X. Start Estate Tax ID (EIN) Application.

Apply for an Estate Tax ID (EIN) Number | How to Apply ...

top www.accioneast.org

3. Apply for an Estate Tax ID (EIN) Number by Phone, Mail or Fax. You can also apply for an estate tax ID (EIN) number by phone, mail or fax. Generally, only international applicants can apply over the phone. Applying for an EIN through the mail or over fax requires the same form. The difference is whether you mail or fax the form.

Video result for estate tax id number application

How to Get a Federal Estate Tax ID Number?

How To Apply For Federal Tax ID number - EIN #

How to Get a Federal Tax ID Number for a Trust?

Deceased Taxpayers - Filing the Estate Income Tax Return ...

trend www.irs.gov

The decedent and their estate are separate taxable entities. Before filing Form 1041, you will need to obtain a tax ID number for the estate. An estate's tax ID number is called an "employer identification number," or EIN, and comes in the format 12-345678X. You can apply online for this number.

How to Obtain a Tax ID Number for an Estate (with Pictures)

great www.wikihow.com

Apply for an EIN if you need one to report estate income on IRS Form 1041. This is the most common reason to apply for an EIN for an estate. If the decedent had income-generating assets, such as savings accounts, stocks, bonds, mutual funds, or rental property, you will likely have to fill out IRS Form 1041, which is an income tax return for the estate.

2021 IRS Tax ID / EIN Online Application - Form SS-4

trend irs-gov-taxid.com

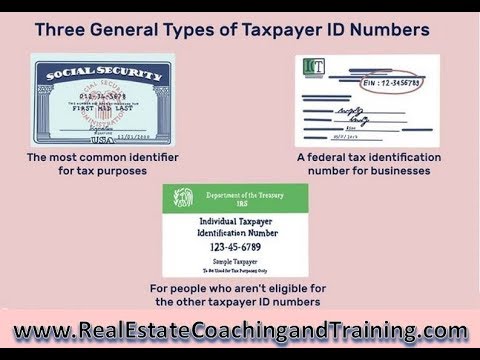

What is a EIN? An EIN, also known as an Employer Identification Number or Tax ID Number, is used to identify a business entity, trust, estate, and various other entity types. All businesses in general need a EIN, according to the IRS. A EIN is usually required for licensing and permitting as well as opening a business bank account.

Get federal and state tax ID numbers

top www.sba.gov

Your state tax ID and federal tax ID numbers — also known as an Employer Identification Number (EIN) — work like a personal social security number, but for your business. They let your small business pay state and federal taxes.

Apply for Estate Tax ID Number (EIN) Online | GOV+

new govplus.com

If you apply for an estate tax ID number, you can expect . the following benefits: It makes it possible to pay off all debts and remaining taxes. An estate tax identification number allows you to maximize tax deductible payments and deductions. For example, . the beneficiary can claim an estate tax deduction for income in respect of a decedent ...

How to Apply for an EIN | Internal Revenue Service

great www.irs.gov

The person making the call must be authorized to receive the EIN and answer questions concerning the Form SS-4 PDF, Application for Employer Identification Number. Complete the Third Party Designee section only if you want to authorize the named individual to receive the entity's EIN and answer questions about the completion of Form SS-4.

Apply For Estate Tin Number Real Estate

tip www.homeszz.com

Apply for an Estate Tax ID (EIN) Number. Real Estate Details: Yes, Estates are required to obtain a Tax ID: The decedent and their estate are separate taxable entities. Before filing Form 1041, you will need to obtain a tax ID number for the estate.An estate's tax ID number is called an "employer identification number," or EIN, and comes in the format 12-345678X.

Estate Tax ID Filing Service | Easily Obtain An Estate EIN

great www.govdocfiling.com

At GovDocFiling, our online estate Tax ID application is an intuitive, single-page form that takes only a few minutes to complete.It includes all the required fields contained on IRS Form SS-4, but every question is written in plain-speak to minimize confusion. Speed and simplicity are not the only reasons estate planners and executors rely on our tax id filing services.

Apply for a Federal Tax ID (EIN) Number - Online Tax ID ...

great www.irs-taxid-numbers.com

Apply for a Federal Tax ID (EIN) Number Who Needs a Tax ID (EIN)? A Tax ID (EIN) is needed to: Open a Business Bank Account Create a Trust Manage an Estate Hire new Employees Start your Application by Selecting your Entity Type Sole Proprietor / Individual Limited Liability Company (LLC) Estate Trust Corporation Partnership […]

Estate of a Deceased Individual IRS EIN TAX-ID Online ...

trend app.irs-ein-tax-id.com

Our paid service will process your application for an EIN/Tax ID number (SS-4 Form) with the IRS to obtain your Tax ID Number and deliver it to you quickly and securely via email. The IRS does not supply Tax ID Numbers via e-mail. Our EIN form is simplified for your ease of use, accuracy, and understanding, saving you time!

Related News

2022 Projected to Be Another Record Year For New Business StartsYour browser indicates if you've visited this link

When new businesses hire employees or incorporate, rather than remain as sole proprietors, they need an Employer Identification Number (EIN ... will apply for a small business loan from a ...

Grantor Trust RulesYour browser indicates if you've visited this link

In this case, the trust itself will pay taxes on the income it generates, and then it would require its own tax identification number ... the owner's estate. Such assets would apply to a ...

15 Key Steps To Form A California CorporationYour browser indicates if you've visited this link

To be eligible to elect S corporation status, the following key rules apply ... to get a tax ID from the IRS for your company. This is also known as an "Employer Identification Number ...

How to Apply for an Employment Identification NumberYour browser indicates if you've visited this link

you need to apply for an employer identification number (EIN). The IRS makes two methods available to obtain an EIN number: completing and submitting Form SS-4 by mail or applying for the EIN ...

How Should an LLC Business File for an EIN Number?Your browser indicates if you've visited this link

Limited liability companies can apply for employment identification ... A single-member LLC may generally use her Social Security number in lieu of an EIN. You should consult a tax specialist ...

Related Videos

How to Get a Federal Estate Tax ID Number?

11:40

How To Apply For Federal Tax ID number - EIN #

3:56

How to Get a Federal Tax ID Number for a Trust?

7:42

How to Apply Online for an EIN (2020)

11:25

Does my Trust or Estate Need a Tax ID Number?

1:35

Video result

How to Apply Online for an EIN (2020)

11:25

Does my Trust or Estate Need a Tax ID Number?

1:35

How To Apply For A Tax Id Number For Your Business!

13:08

How To File For A Tax ID Number | Estate Planning |...

2:03

Learn How To Apply For An EIN Number For Free -...

11:56

HOW TO APPLY FOR A TAX IDENTIFICATION NUMBER

16:44

How To Apply For An Individual Tax Identification...

2:16

How to Get a Tax ID on the IRS Website - form ss4

3:22

Learn How to Fill the Form SS 4 Application for EIN

2:20

How Executor Gets an Estate of a Deceased Individual...

2:02

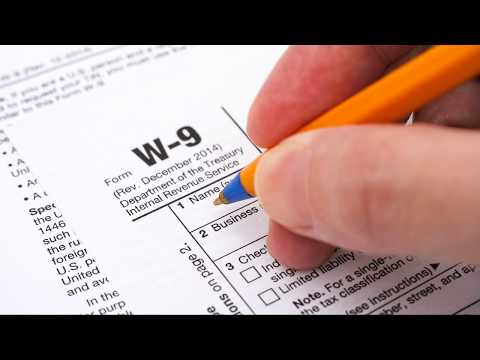

W-9 Request For Taxpayer Identification Number And...

17:11

Apply for IRS Employer Identification Number (EIN) for...

12:09

How to Fill out IRS Form SS-4

13:01

How to Apply for an EIN Online

8:11

Do you need a tax ID number for your trust?.

2:49

How to apply for EIN with IRS

8:58

EIN Applications for Nonresident Owners of U.S. LLC's

17:22

How to Apply for an EIN in 3 Minutes for FREE

2:58

How to get a Tax ID (ITIN) in the United States - And...

3:28

How To Apply For Tax Id Number | 10 Day Challenge (Day...

5:31

How to Get an EIN and State Tax ID Number

3:08

LLC Federal Tax ID Number (EIN)

8:46

How Can I Get a Tax ID Number

1:21

What is a Tax Identification Number | Selling a House...

5:39

5 Things you MUST know about TIN | How to apply for a...

5:38

Learn How to Fill the Form W-7 Application for IRS...

1:55

Individual Tax Identification Numbers (ITIN) by Kahane...

1:25

Where to apply for a SALES TAX ID Number in Georgia?...

5:23

How Get a EIN Number For Your Dropshipping Business

8:13

How to apply for a IRS PTIN

5:12

How to complete Form W-7 and get a US Tax...

4:51

EIN number. How to get your Employer Identification...

11:28

Applying for a Tax ID Number

1:17

How To Get Your Tax ID Number for FREE! (TIN) - Free...

6:58

ITIN Mortgage Loans - Buying a Home without a Tax ID...

3:37

How To Get Your EIN (Tax ID Number) For Free In 2021

7:25

WHO NEEDS TO APPLY FOR AN INDIVIDUAL TAXPAYER...

2:33

Tax Help : Do I Need a Sales Tax ID Number?

0:52

How to complete Form W-7 ITIN (Line-by-line...

10:43

Getting Tax ID Number in Turkey as a Foreigner

1:57

BBMP | How to find new PID number to pay property tax

2:26

How Do I Obtain a Tax ID Number?

1:26

How To Get Your EIN (Employer Identification Number)...

7:51

"How to Get an EIN / Tax ID Number for your Business"...

1:12

Five Things to Know about the Employer Identification...

1:31

Tax Identification Number for Foreign Real Persons

0:45

Individual Taxpayer Identification Number ITIN

3:25

HOW TO APPLY FOR TAX IDENTIFICATION NUMBER( TIN) |2021...

5:32

EIN lookup - How to Find an EIN

3:08

How to Find and Use Your Business Tax ID

5:17

What is an ITIN (Individual Taxpayer Identification...

0:40

HOW TO FIND A PROPERTY TAX ID NUMBER ("PIN NUMBER") IN...

5:39

Federal Tax ID Number (EIN) for Your Business

10:56

Easy way to know the PTIN (Property Tax Identification...

2:47

HOW TO GET YOUR EIN NUMBER FOR FREE | APPLY FOR AN EIN...

20:00

How to get EIN or ITIN Number as a NON-US Resident ?

2:36

Related News

2022 Projected to Be Another Record Year For New Business StartsYour browser indicates if you've visited this link

TheStreet.com

Grantor Trust RulesYour browser indicates if you've visited this link

Investopedia

15 Key Steps To Form A California CorporationYour browser indicates if you've visited this link

Forbes

How to Apply for an Employment Identification NumberYour browser indicates if you've visited this link

you need to apply for an employer identification number (EIN). The IRS makes two methods available to obtain an EIN number: completing and submitting Form SS-4 by mail or applying for the EIN ...

Houston Chronicle

How Should an LLC Business File for an EIN Number?Your browser indicates if you've visited this link

Limited liability companies can apply for employment identification ... A single-member LLC may generally use her Social Security number in lieu of an EIN. You should consult a tax specialist ...

Houston Chronicle

Form 1041: U.S. Income Tax Return for Estates and TrustsYour browser indicates if you've visited this link

Form 1041 is an IRS tax return used to record income generated by assets held in an estate or trust. Learn how it works and instructions for filing.

Investopedia

Do You Need An Ein For Business License?Your browser indicates if you've visited this link

Here is how to apply for an employer identification number. Is Business License ... Obtaining an EIN may be necessary for a variety of reasons, including for business purposes, estate planning, and trust banking. In addition to employment tax returns ...

ICTSD

Can I Use Ssn As Business License Number?Your browser indicates if you've visited this link

A customer with a Social Security number and an estate account has the same EIN with ... to file taxes and apply for credit. disregarded entity will not use its own EIN to file tax returns or report income. LLCs are instead required to use the owner ...

ICTSD

How to Start a Business: A Step-by-Step GuideYour browser indicates if you've visited this link

If you're in a general partnership or a proprietorship operating under a fictitious name, you may need to apply for a DBA ... resale ID, state tax ID number, reseller number, reseller license ...

Business News Daily

Tax-Filing: Here's What to Know About ITINs and the Form W-7Your browser indicates if you've visited this link

To get an ITIN, you must file the Form W-7, which is the IRS application for an individual taxpayer identification number. Applicants can apply by mail, through an acceptance agent or in person at ...

U.S. News & World Report

3 Ways to Invest Your Passive IncomeYour browser indicates if you've visited this link

The usual ones that come to mind involve real estate rental and interest ... you will need to apply for a federal EIN number. If you have plenty of funds to spare, you're in luck.

InvestorPlace

Is Your Company Ready for the New Partnership Tax Audit Rules?Your browser indicates if you've visited this link

Partnerships are one of the most commonly used business and estate planning tools ... have a U.S. address, and a U.S. Tax ID number. This allows the IRS to communicate with one designated ...

Kiplinger

How to Run a Business in CaliforniaYour browser indicates if you've visited this link

The top five industries in the state are finance, insurance, real estate ... number that begins with the four digits of the year of incorporation. These numbers are distinct from tax ID numbers ...

Business News Daily

Dexus Finance Pty Limited: Sale of 309-321 Kent Street SydneyYour browser indicates if you've visited this link

596/2014, übermittelt durch DGAP - ein Service der EQS Group AG ... The sale was the result of an on-market sales campaign and is subject to a number of conditions including FIRB application and approval. Subject to the satisfaction of conditions ...

dgap.de

Ways to GiveYour browser indicates if you've visited this link

The Real News Network (Independent World Television, Inc.) is a 501(c)(3) nonprofit organization, our federal tax ID number (EIN ... therealnews.com to share your estate plans.

The Real News Network

How to Check if Someone Has a License to Sell Real Estate in CaliforniaYour browser indicates if you've visited this link

Although the minimum requirements for getting a real estate license vary by state, in general, a person must graduate high school or earn a GED certificate, complete a certain number of credit ...

SFGate

The Affordable Connectivity ProgramYour browser indicates if you've visited this link

Similarly, the FCC is proposing that all existing EBB Program providers need not file or resubmit a new application to participate ... Employer Identification Number (EIN), Tax Identification ...

The National Law Review

Public Service Loan Forgiveness just got easier for 550,000 borrowers: Who qualifies and how to applyYour browser indicates if you've visited this link

Here's how to apply: If your application is approved, the remaining balance of your federal student loan debt will be forgiven after you make 120 qualifying payments. Even with these changes to ...

Fox Business

Aquis Stock Exchange: Updated announcement of application for admission - RentGuarantor Holdings PLCYour browser indicates if you've visited this link

DJ Aquis Stock Exchange: updated announcement of application for admission Aquis ... PRINCIPAL PLACE OF BUSINESS (IF DIFFERENT) AND TELEPHONE NUMBER: Registered Office Finsgate 5 - 7 Cranwood ...

Finanznachrichten

Omicron Deals Another Blow To The Hard Return-To-Office DateYour browser indicates if you've visited this link

"Our view is that [returning] to the office was less about health and safety and more about worker autonomy," said Kastle Systems Chairman Mark Ein ... impact on real estate and office ...

Bisnow

5 Best Business Checking AccountsYour browser indicates if you've visited this link

While Novo doesn't charge to use these apps, some partner fees may apply. The account also includes ... BlueVine's Business Checking places no limit on the number of daily/monthly deposits ...

MSN

Licenses & Permits for Small BusinessesYour browser indicates if you've visited this link

Federal Licenses and Permits: For a very small number of businesses ... A benefit to having an EIN is that it can help you establish credibility with whom you do business. Fortunately, the Internal Revenue Service makes it very easy to apply.

Santa Clara University

The best small biz loan options for startups, small businesses and solo entrepreneursYour browser indicates if you've visited this link

In order to help you find the best loan for your needs, Select reviewed five different types of loans: term loans, equipment loans, commercial real estate loans, microloans and franchise loans.

CNBC

Office Occupancy Hits New Pandemic-Era HighYour browser indicates if you've visited this link

While patrons have been filling up restaurants and fans have been crowding sports stadiums and concert halls, the return to the office has lagged, Kastle Chairman Mark Ein said. That dynamic has ...

Bisnow

What brought down Chris Cuomo? The same thing that brought down his brother.Your browser indicates if you've visited this link

Arrogance, the entitled belief that the rules don't necessarily apply to them ... "(Cuomo) has made a number of accusations that are patently false. This reinforces why he was terminated ...

Poynter

5 Best Business Checking Accounts of December 2021Your browser indicates if you've visited this link

While Novo doesn't charge to use these apps, some partner fees may apply. The account also includes ... BlueVine's Business Checking places no limit on the number of daily/monthly deposits ...

Arizona Daily Star

All Questions and Answers related to estate tax id number application are always updated

estate tax id number application - Find the best answer for your question just with a click!

Does Exampleask.com keep updating the latest information about Estate Tax Id Number Application?

Yes, definitely. We always keep updating the latest information about Estate Tax Id Number Application every day to make sure that you get the updated examples about your language programming.

Can I contribute my reviews or feedback related to Estate Tax Id Number Application at Exampleask.com?

Exampleask.com always wants to know your feedback in the processing of using the data we provide. So, if you have feedback related to Estate Tax Id Number Application, feel free to contact us via email: contact@exampleask.com.

How can I become a partner with Exampleask.com?

If you are interested in becoming our partner by submitting coding examples or advertising, feel free to contact us via email. Our customer services will contact you as soon as possible.

Is all the information about Estate Tax Id Number Application reliable?

All data is selected carefully from reliable sources and related to Estate Tax Id Number Application. We always prioritize all prestigious sources and make sure to meet your expectations.

Where to Get Reseller Permit and Sales Tax Number in Reno Nevada

Source: https://www.exampleask.com/estate-tax-id-number-application

Post a Comment for "Where to Get Reseller Permit and Sales Tax Number in Reno Nevada"